This post is sponsored by Adobe Document Cloud

Tax Prep can be daunting if you haven’t worked on taxes throughout the year. Staying organized is important so you’re not hunting and digging through paperwork that’s in piles when it’s time to get all your tax documents together during Tax Season. I have put together my favorite tips so you can have a system for making your tax prep easier!

11 Ways to be Organized for Tax Season

1. Ask 3 Friends for Tax Pro Recommendations in your area

Research tax pros in your area. Ask friends and family for recommendations. Call and find out what rates different professionals charge and then meet with them to determine if they’ll fit your needs. Some people also choose to do their own taxes and if that’s you, just make sure you know what you’re doing.

Some of you may also use at-home software. If you do this go ahead and purchase your software early so you can start updating or inputting the information you already have.

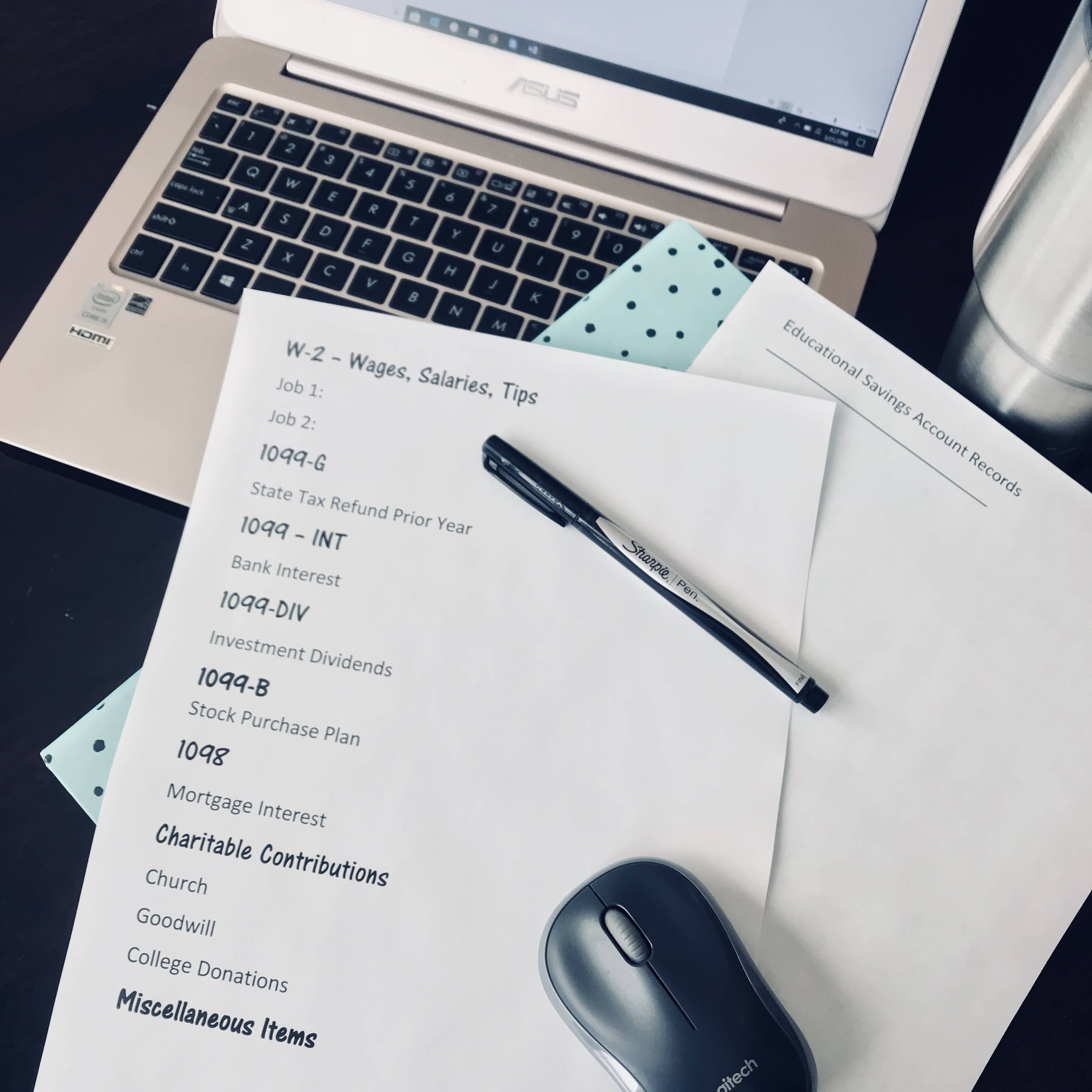

2. Make a List of Documents Required to File Your Taxes

I would suggest making the list this year while you’re doing your taxes, because you’re already gathering all the documents. Make a few copies before you start marking on it. You could also laminate it or place it into a clear plastic sleeve so you can reuse it each year!

As you receive the items on your list, check them off. Sometimes we forget documents we need to get to our accountant because they aren’t on the accountant’s worksheet. This list will really help you stay organized.

3. Turn paper documents into PDFs

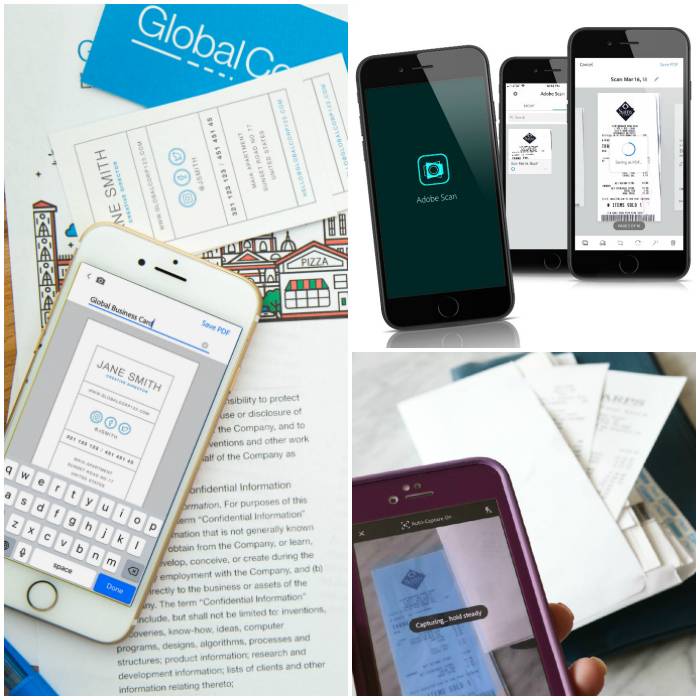

Download the Adobe Scan mobile app on iOS or Android, to easily scan receipts and tax documents on your mobile device. Get rid of paper clutter! Scan tax-deductible receipts, your W-2, 1099’s and more!

Download Adobe Scan app for FREE

The documents you scan are then turned into PDF files that can be edited and searched for within Adobe Document Cloud. Save your sanity by scanning your paperwork for quick access anywhere.

Watch the full Adobe Scan Tutorial

4. Create a File Folder for the Current Tax Year

As you receive paper documents that you know you’ll need for filing taxes, just slip them into your file folder for the current year. That way you aren’t digging through multiple files or stacks of papers looking for that one document you needed when you’re trying to get all your tax paperwork together.

Even better, digitize those documents using Adobe Scan as soon as you get them. Then when tax time comes, you’ll already have all your documents stored digitally which make them easier to work with and share with your accountant.

You may also want to create multiple folders, both physical and digital, if you have a lot of paperwork that needs to be kept separate such as a personal business, a rental property, etc.

5. Combine and Securely Share Documents

Now that you have all your important papers scanned with Adobe Scan, and stored in Adobe Document Cloud, you can seamlessly organize your tax documents using Adobe Acrobat DC.

You can easily combine documents in Acrobat DC and email files directly to your accountant.

I also personally love that you can encrypt your documents with passwords so only those that you’ve authorized to view your documents can actually view them adding an extra, layer of security.

Sign Up for an Adobe Acrobat DC Free Trial

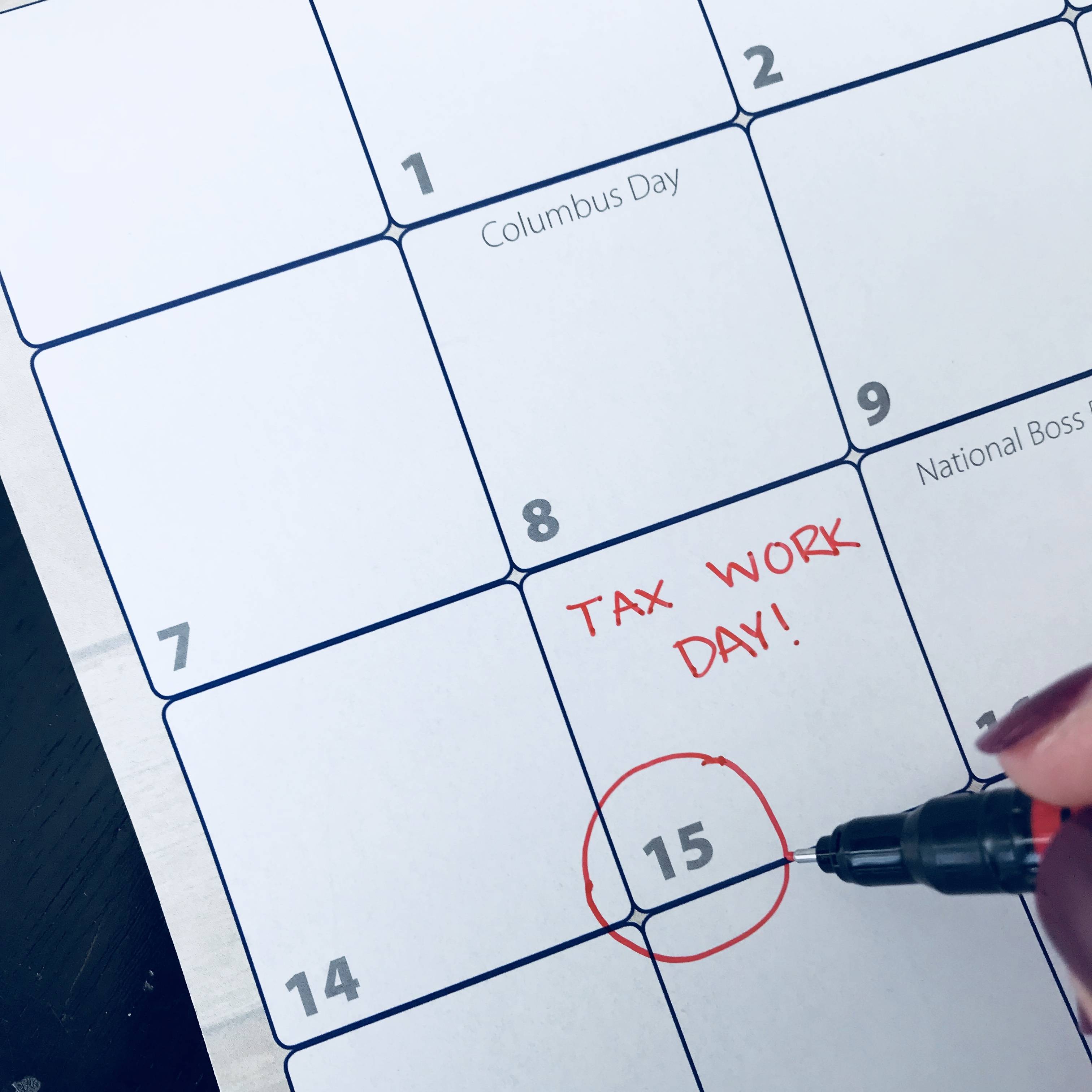

6. Schedule 4 Dates on Your Calendar to Work on Tax Documents

These dates are scheduled once a quarter and should help you stay on top of your paperwork so you don’t have a huge project once your end of year statements start coming in the month of January. It’s overwhelming to find and organize all your important tax documents all at once. By scheduling dates to work on your taxes – whether that’s scanning receipts with Adobe Scan, organizing paperwork, filing, computing donations or something different you will stay on top of much of the work this way.

Date Suggestions – January 31, April 30, July 31, October 31

7. Donate Items Quarterly

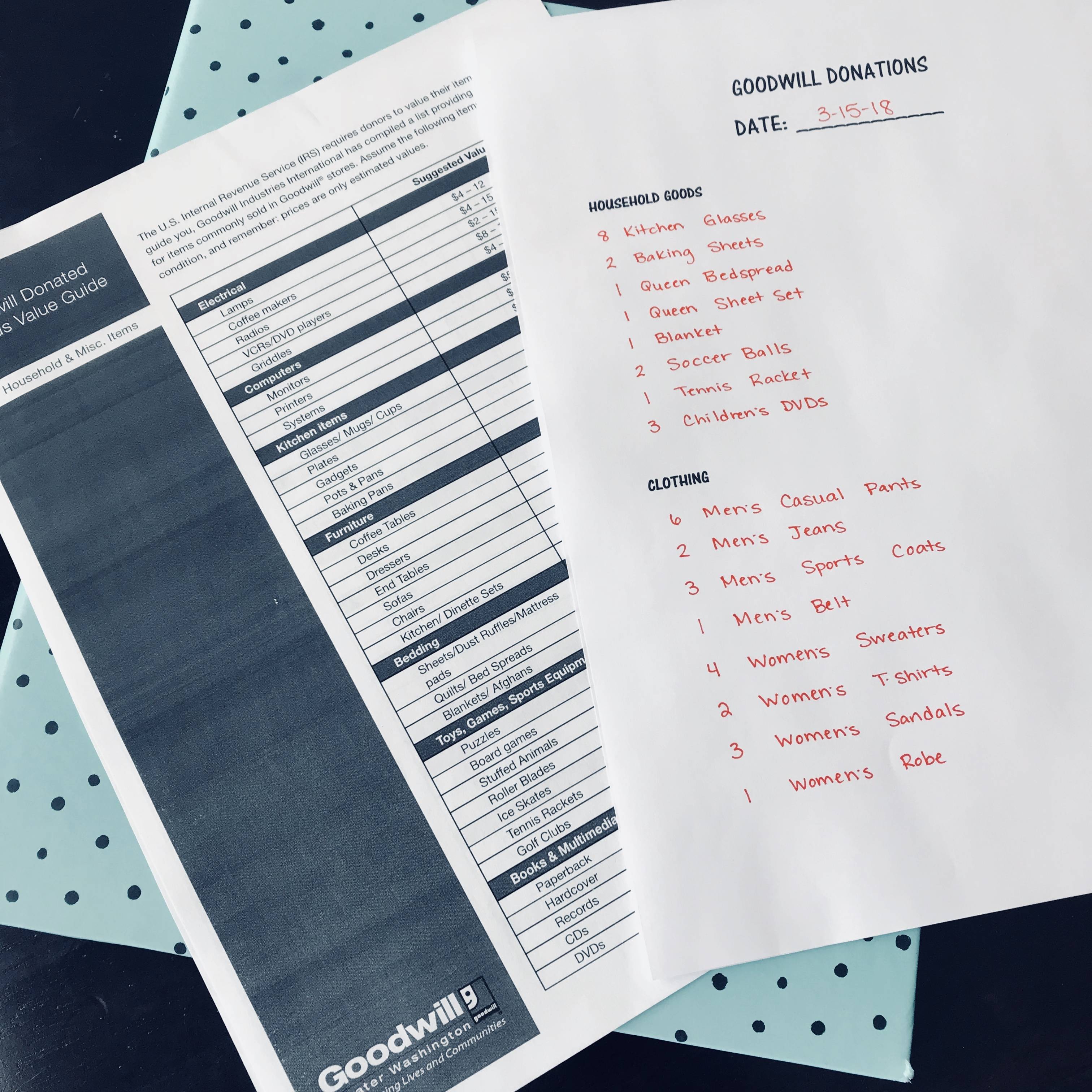

Keep a tote specifically for donations with a piece of paper taped to the top and a pen. When you put something in the tote, write a description of the item on the paper.

At the end of each quarter, take the donation to your favorite charity, get a receipt and staple the receipt to the list of items you donated. Valuate the items you donated when you work on your tax documents on your scheduled date. Put that into your file folder for the current year and then you can scan it with Adobe Scan when you’re doing your quarterly scanning!

There are some valuation methods online that I’ve found for resources. Some of the main places this would pertain would be to thrift stores such as Goodwill and Salvation Army plus any local thrift stores you have in your area.

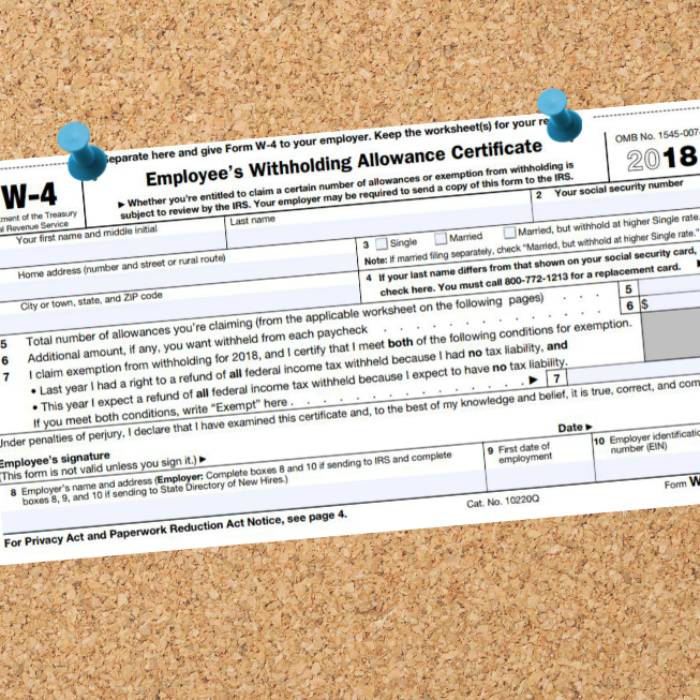

8. Review Your W-4 Annually

Some people love to get a big return, and others like to keep their own money during the year and get a minimal return. You might ask why someone wouldn’t want a big return? Well, you get more money in your paycheck and you’re not loaning the government tax free money. When you get a huge refund that just means you had too much tax withheld all year that is rightly yours. Adjusting your withholding allowances will balance this out.

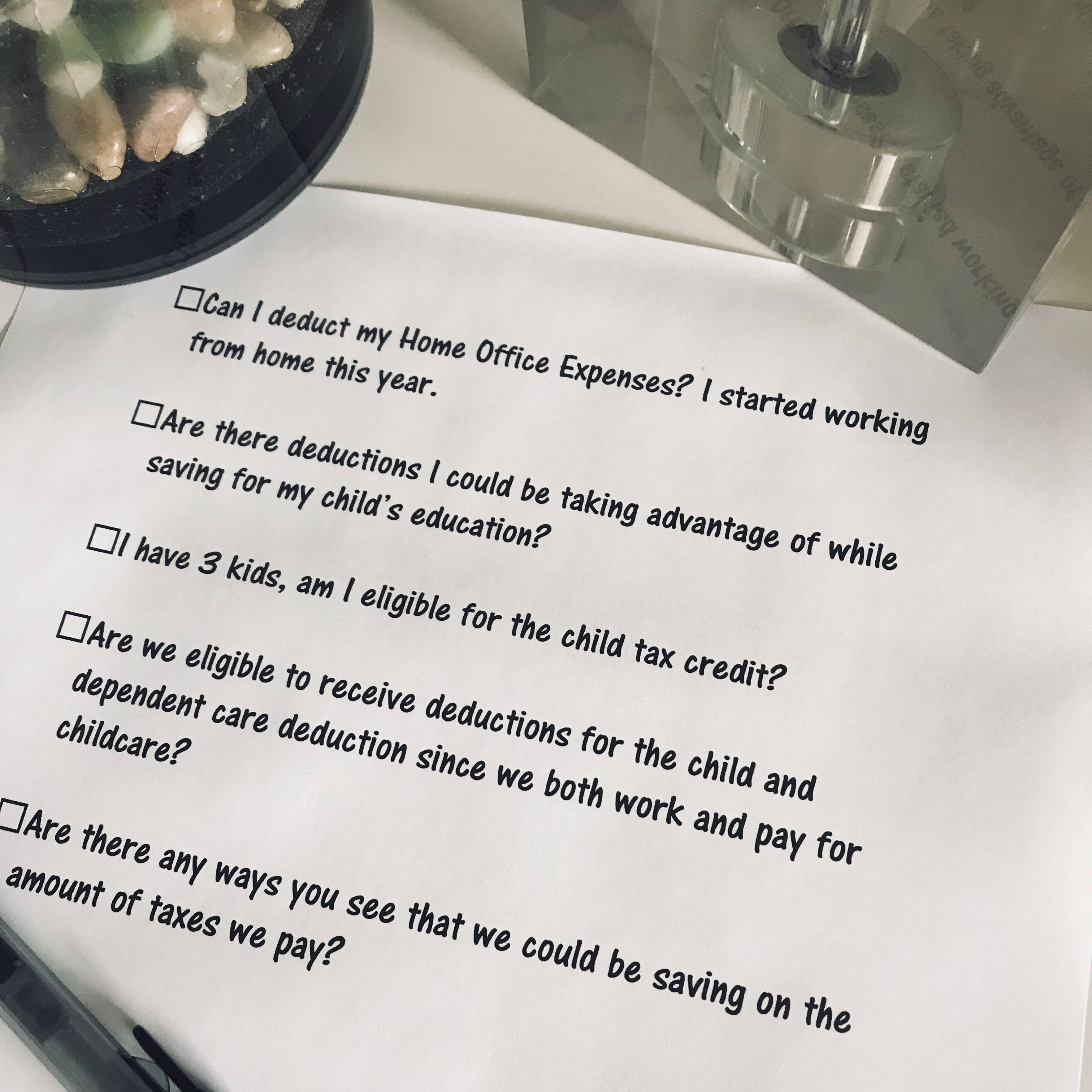

9. Make a list of questions for your Tax Advisor

You know when your Tax Advisor asks you if you have any questions and you’re not prepared to ask any? That’s the worst because you know you have several questions you just can’t think of them on the spot. This is why having a log for questions to ask your tax advisor at your appointment is super helpful! I suggest keeping that list in your file so you can refer back to it the following year. You can even store it in Adobe Document Cloud for easy finding on a yearly basis.

10. Maximize Your Contributions

Check your contribution limits towards the end of the calendar year or the first part of the new year to see if there is more you can contribute to maximize your tax benefits.

If you file your return early enough and you haven’t maximized your contributions that give you tax benefits, you can contribute through mid April and still use that deduction for the previous tax year.

Check with your financial institution where your accounts are located and your tax advisor for help with this to determine if it’s a good fit for you and if you qualify.

11. Double & Triple Check Your Work

Checking for omissions is important when gathering all your documents together for your tax professional or yourself if you’re doing your own taxes. It’s a great idea to talk to someone else in your household about your taxes just to be sure that they haven’t thought of something you might have forgotten about. Being accurate also speeds up your processing time because if errors are found or paperwork isn’t sent in, your tax refund will be delayed.

Disclosure: This post is sponsored by Adobe Document Cloud. I was compensated to share this information with you, however all thoughts and opinions are my own.