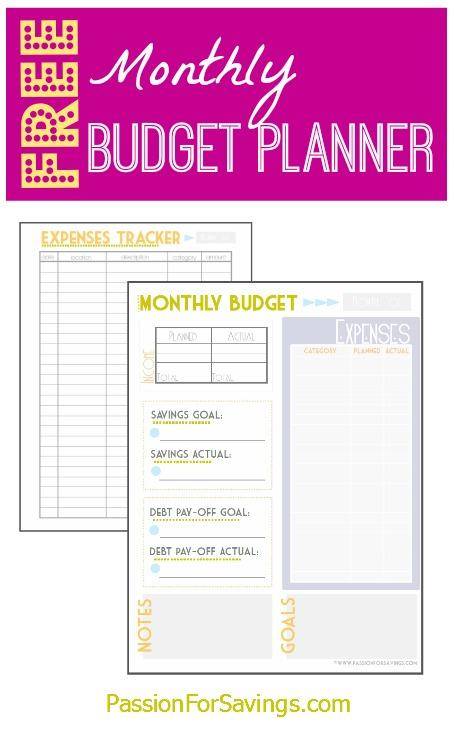

Free Budget Planner Download

It’s the New Year and I know that a lot of you are going to love this Free Budget Planner! If you are setting goals to get out of dept and save more this year then this is a great way to keep your expenses under control by being Pro-Active and Planning your Budget Expenses at the beginning of the month!

It’s not too late to use the Free Budget Planner this month! You can start any time. Just list your total income, Then use this form to create categories and assign amounts to each category. You can track your expenses on the Expenses Tracker and then move the actual amounts to your budget worksheet.

One of the things that is always overwhelming when setting a budget is knowing exactly what categories to create and how much you need to assign to each.

You may find that the first few months you’re moving things around a little, but over time by tracking your planned vs. actual expenses you should be able to get a much better idea of what you are spending in each category which in turn makes your budget worksheets more accurate each month!

This is a great time to start tracking your savings goals and your Debt Pay off Goals! Nothing motivates me more when saving or paying off debt than seeing the progress! So Set some goals and strive towards them!

This Free Printable Download contains the Free Budget Planner, and it also contains a Goals Worksheet. So if you are still needing to set your goals for the new year make sure you download these pages and use them to get started!

Tips for Using this Free Budget Planner:

- Start by Writing Down your Planned Income for the Month, If you have a Salary Job this should be easy. If you work hourly or have a flexible income write down what you estimate you will bring in.

- It’s important to Plan for Savings & Paying Down Debt First! If you wait till you have assigned amounts to each Category you won’t have any money left over :) So Pick a realistic amount, you may even want to start small and increase this each month through the year.

- List Categories with the MOST IMPORTANT FIRST! So if you have a Mortgage, Car Payment, Food, Utilities, etc. List out those big expenses that you must cover each month first. Then continue down the list. Once you have a list of items you spend money on, start assigning amounts in the “Planned Category”

- Assign Amounts until all of your income is assigned. If you listed the most important first and started at the top, the categories at the bottom may or may not be funded depending on your income. At this point you can adjust other categories or leave these Un-funded. If your income isn’t fixed you can use any extra income that was unexpected in the month to fund these budget categories. This is called a Flexible Spending Budget. Where you start at the top and fund the most important items first, then you work your way down the list as income comes in, that allows you to make sure you are covering your most important items first.

- Use the Expenses Tracker to track your Actual Expenses during the month. At the end of the month you can add up the totals for each category and place the actual amounts spend on your Monthly Budget so that you can get an idea of how accurate your budget is.

We have an Awesome 31 Day Journey on How to Make a Budget that you will want to check out! This is a great series on Setting Goals, Making a Budget and Paying Down Debt!

Make sure you check out our Saving Money Blog and also our How to Coupon Page for more tips, tricks and videos on saving money and using coupons.

im soo in love with this new budget planner. its so cute!!!