Grab these Free Printable Dave Ramsey Budget Forms, and get on track for this year. The Dave Ramsey system has been so useful for our family in becoming debt-free! We created this beautiful watercolor-inspired worksheets for you, which can be used with that system.

So, while you gain control over your finances, you’ll have lovely forms to use in the process! I’m going to explain to you exactly how each form works! They’re so EASY to use, and they’re cute, too!!

Free Printable Dave Ramsey Budget Forms

Click Here to Download the Dave Ramsey Budget Forms! They are free to print and will truly help get you all set up to grow and tackle your budget. Save money and budget easily.

Quick Start Budget

This first form is a very basic get your feet wet sort of budget! If you’re new to the budgeting process, it’s a great place to start and see where you’re at.

First, write your income(s) at the top and that’s what you’re working with. Next, write down what you spend in each section. Of course, this doesn’t go into much detail or include debt, but we’ll talk about that later!

Once you have the basics all down on paper on your Quick Start Budget form, it’s easy to see how much you spend on these essential items.

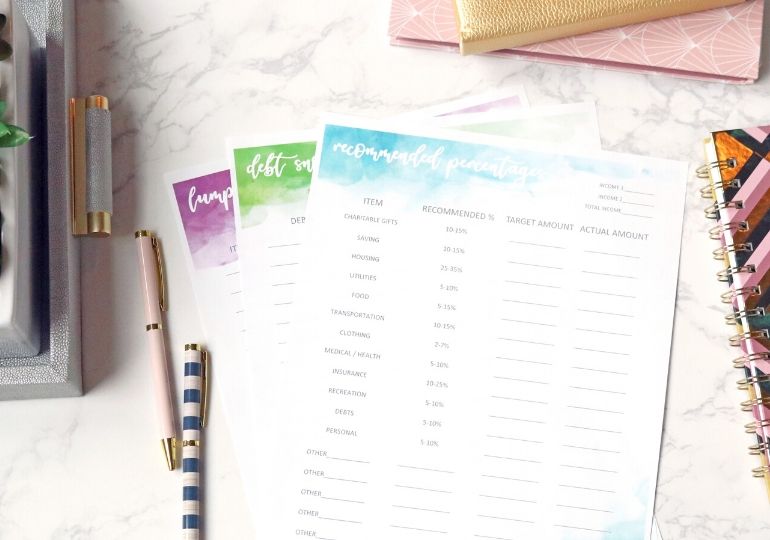

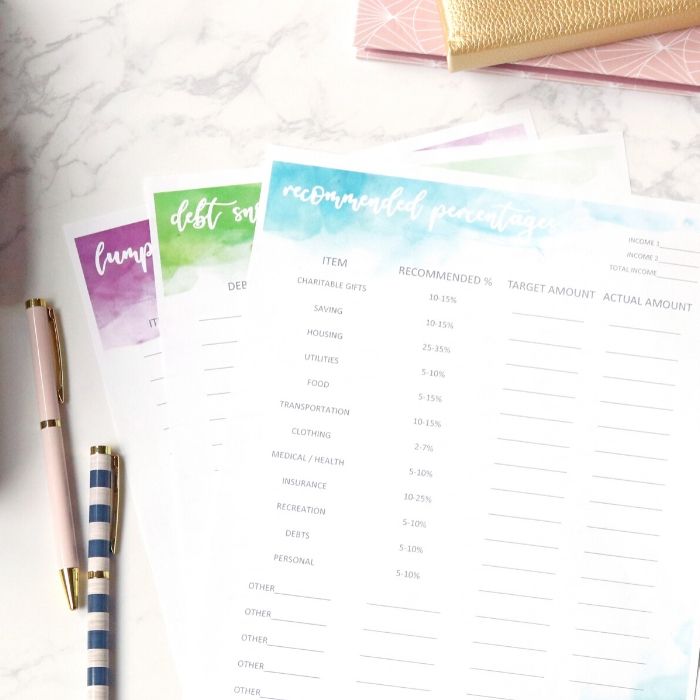

Recommended Percentages

The next worksheet, Recommended Percentages, is so helpful for seeing what percentage of your income is recommended for setting up your budget. This might fluctuate a bit depending on your family size and your income, but it will give you an idea! (For example, a family of three would have an adjusted recommended percentage of income for food from a family of eight.)

If you have a higher income, your percentage that you spend on food will be less, as well. Using this sheet, you’ll get your targeted amount that you’ll spend in every area. In the first column, you’ll calculate your targeted percentage.

You’ll multiply your income by the percentage in the recommendations. In the second column, you’ll write your actual percentage using the amounts you are currently spending. You can adjust your percentages in the targeted column so they add up to 100%.

Debt Snowball

On the Debt Snowball sheet, you’ll write every single one of your debts out, from the least amount you owe to the greatest amount you owe. (The interest rate does NOT matter for this!!)

Each month, you’ll continue to make the minimum payments on every payment except the one on the first line. For the smallest debt, pay as much as you can each month until it’s gone.

Once it is, take all of the money you were paying on that debt and put it toward the next smallest debt, while continuing to make the minimum payments on all other debt. Every time you pay off a debt, cross it out!

Lump-Sum Payments

This sheet helps you plan for expenses that aren’t reoccurring monthly, like taxes or insurance premiums. First, you’ll list who you’re paying in the left column, how much cash you need to pay in the Amount Needed column.

Under the month’s column, write how many months you have to save for it. For example, if you make a payment twice a year, you’d put a “6” in the month’s column. You’d have six months to save for it.

Your budget column is for how much you’ll need to budget each month for that larger lump-sum payment expense. If you save a smaller amount each month, the larger lump-sum won’t be an issue when it comes time to pay it!

Income Sources Recap

Many of you have incomes coming from different places and at different times. This sheet helps to get it all down on paper, so you have a concrete number with which to plan your budget! You write how much you’ll receive and when it’s expected.

Breakdown of Savings

On this sheet, you’ll write your savings goals for every section, as well as a place to write how much you currently have saved. If you know anything about the Dave Ramsey system, you know that he recommends saving $1,000 for your initial emergency fund. That is your first savings goal!

You can read more about this on the Dave Ramsey site and in his books. This sheet will remind you that every single dollar in your savings account(s) is labeled and already reserved for something.

Credit Card Payoff History

This sheet will give you a record of your credit card payoff information. Whenever you pay off a card, you can write down all of the important details! There is a column for the card name, the card number, the mailing address of the credit card company, the phone number, the date you closed the account as well as the confirmation number you received when you closed it. These are all important things to have on file in case something inaccurate appears on your credit report.

Detailed Budget Spending

This sheet is my favorite!!! This will literally give every single dollar in your budget a name and a place to go! There is a column for carryover column for funds not spent during the last budget period.

Next, is the column for the actual amount you have budgeted. So you add the carryover and the budgeted and that will give you your total to spend each budget period. After the budget period, you write the total you spent. Then, if you have any left, you can add that into the remaining column.

So then the next budget period, you can take the remaining amount and enter it into the carryover account. There are such detailed sections on this worksheet!! We also have numerous lines you can fill in and customize!

We also have cash trackers that are conveniently sized for your wallet or purse. These will help you track every dollar you spend!

I can’t wait for you to use these watercolor style budget forms!! They’re so pretty to use and will help you gain control of your finances if you follow the Dave Ramsey system! This download will truly change your life and also has the potential to change the lives of your children, too!